You can download these 12 Free Bank Account Statement Templates in MS Excel and MS Word format to understand what it look like. When It comes to sending account statements to your client no matter what business you belong to. You can study the following wonderful yet comprehensive Account Statement Templates that can help you to effectively communicate account status (debit or credit) to your clients professionally. These Financial Statement templates have two parts: A cover Letter and a Sheet to list recent transactions or details of a specified time period. It is also a good practice to send your client their account statement on a regular basis no matter if they specifically asked for it or not. Such practice always leads to pro-active actions on the client’s end especially when they have a debt balance with you. Despite the fact that it has a cover letter in itself, this Statement Template is created using MS Excel to help technical persons use it with less effort.

Contents

Using Bank Statement Templates

An Accounting Statement is generally a financial statement that gives information about the activity in an account or the whole business. Accounting statements are a usual document that is used in all kinds of finance operating companies and firms such as loan companies, banks, and stock exchanges. If we talk about an accounting statement related to a bank, it shows the total amount in an individual’s account, the transactions, deposits, and the added interests or deducted services charges. Most banks and firms provide these statements free of cost and you can have the statement in both paper and digital form but some companies charge a little when you ask for a paper statement in order to discourage the customer from using paper and motivate him to go with paper-free methods. These statements vary from bank to bank but generally, an accounting statement includes the account number, name, and contact information of the owner of the account. Here some banks also like to mention the type of account such as savings or current.

Free Bank Statement Templates

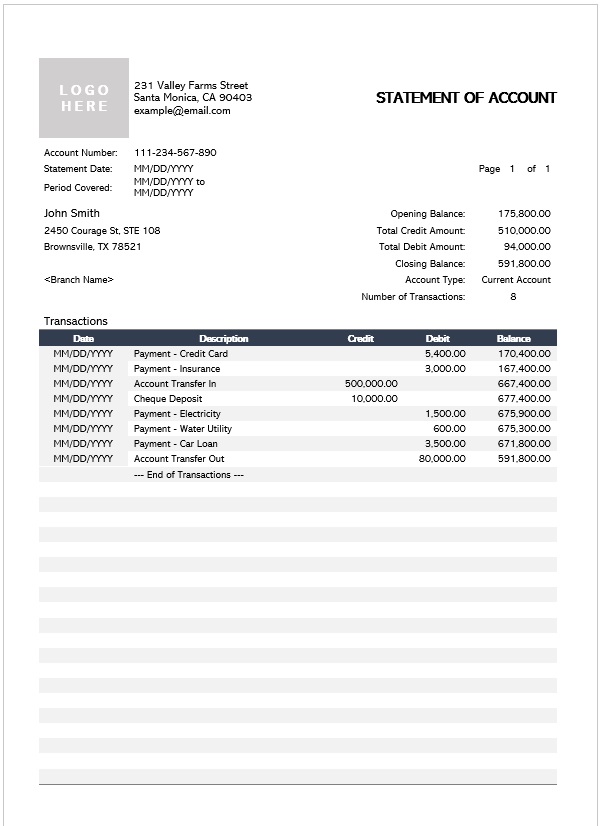

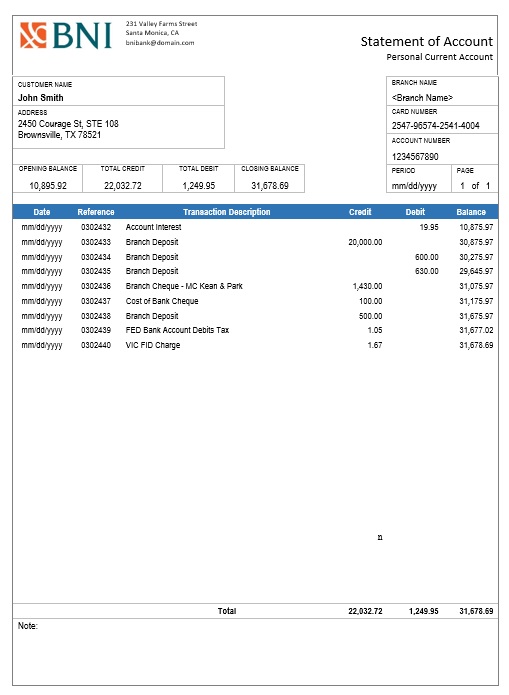

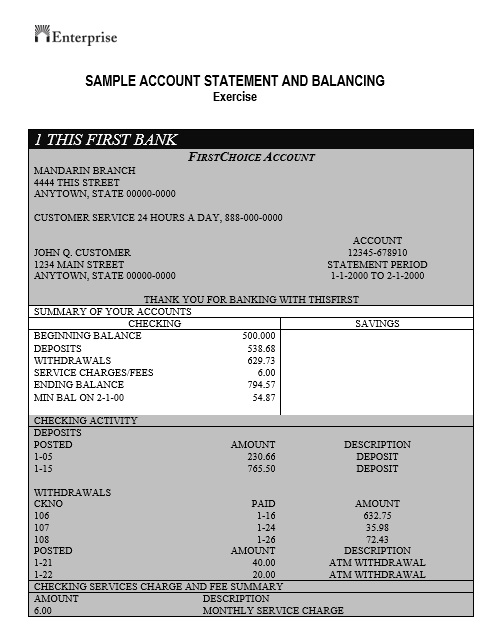

Here is a preview of this Account Statement Template created using MS Word,

Here is the download link for this Financial Statement Template in MS Word format.

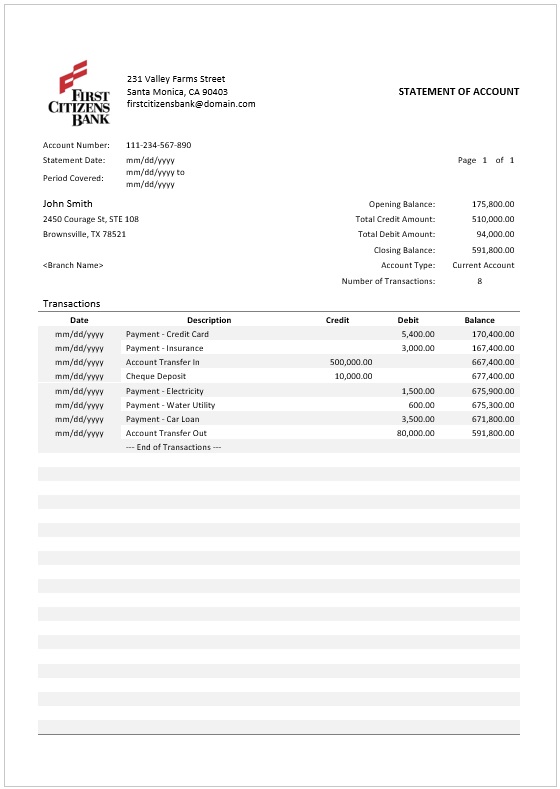

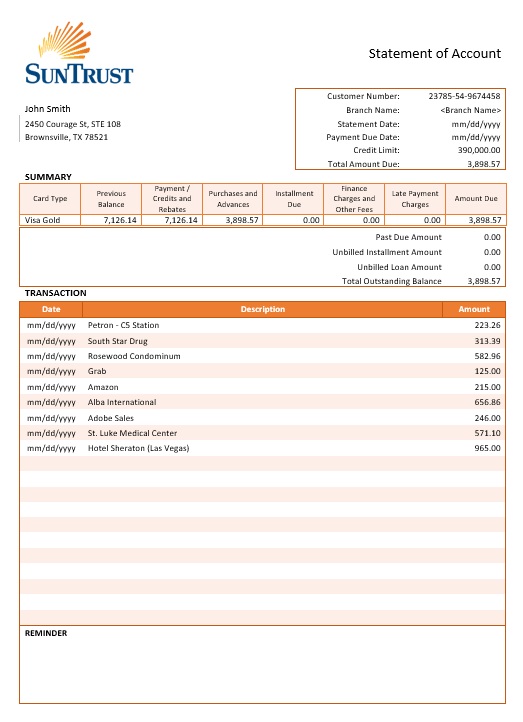

Here comes another useful Bank Statement in MS Word format to help you prepare your own Account Statement quickly.

Download the link for this MS Word Financial Statement Template.

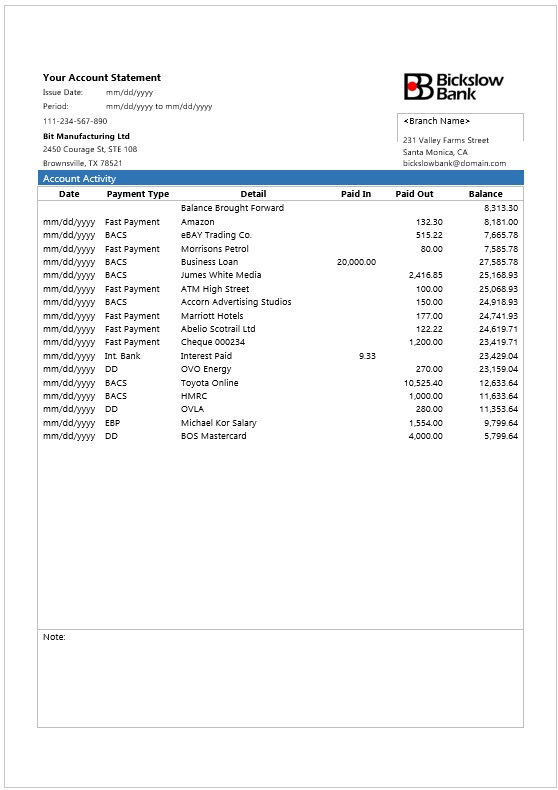

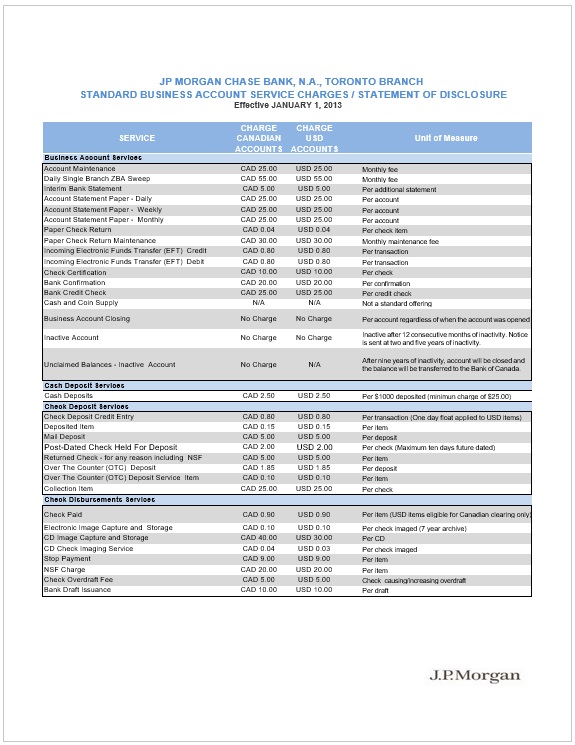

Here is the download link for this Financial Account Statement Template as a fillable Form.

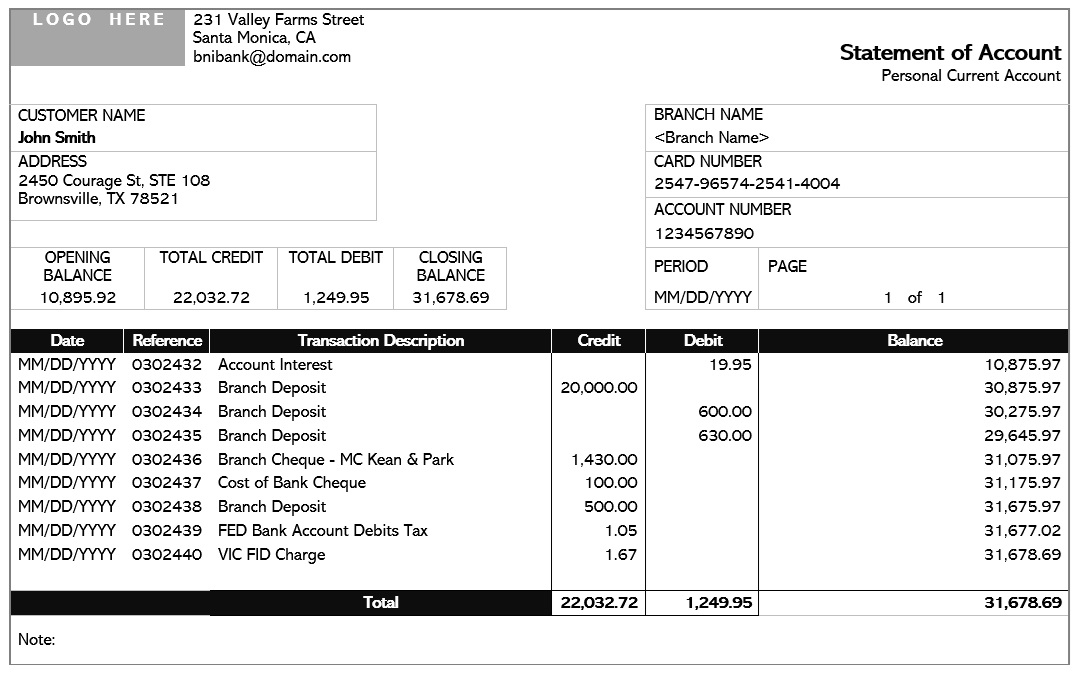

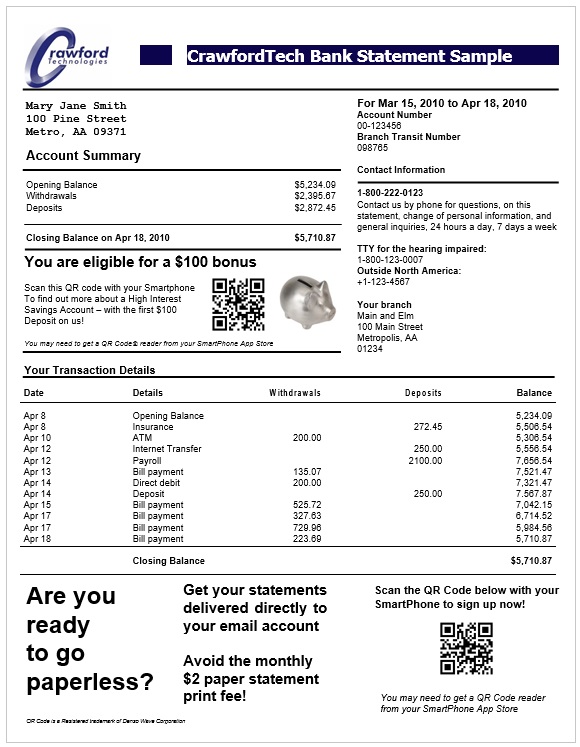

Another printer-ready Personal Financial Statement Template that can easily be printed using any home or office printer. It doesn’t require too high word processing skills to create a professional statement quickly.

Please click on the button below to start downloading this Statement Template.

These statements are prepared over a period of time such as at the end of every month, or after every three to six months depending upon the strategies running in a particular bank. When a customer gets his account statement, with a quick glance, he sees all the financial transactions in his account over the last accounting period. Most of the time, banks issue these statements automatically but if someone wants, he can get his account statement any time he wants. The main purpose of this statement is to reveal the total amount of debt, credit, and the remaining balance in an account. Although an accounting statement is just a piece of paper sometimes banks also send an additional document that includes the transactions in detail and in a more brief way.

Generally, an accounting statement includes 10 basic elements but some of them are not that essential so here are the 5 key elements of a statement:

1. Assets:

an asset is something that is owned by a company or organization and has some future market value. For example, a building is an asset for a business or the furniture in the classrooms is an asset for the school. The cash in hand, investments in other businesses, accounts receivables and vehicles are also an asset of a business. Assets are further divided into two categories; non-current and current assets.

2. Liabilities:

liability is the exact opposite of an asset in businesses and companies. Liability is the amount of money that you or your company owes to someone else. For example, a company buys a truck for delivery purposes but pays the amount two months after the purchase so this truck is a liability of that company until it pays its full price to the supplier or seller.

3. Equity:

anything that represents the ownership in a company is called equity. For example, a company bought a building but didn’t pay for it right away so now it’s a liability and the company can’t sell it to another person but when it pays to the seller in full, now it’s equity of the company and it can sell the building to anyone. Sometimes it’s also referred to as stakeholder’s equity.

4. Income:

a company’s total earnings including the profits on sale and interest rates are called the income of a company. It’s actually the amount of money that is incoming in a company or business and it’s sometimes also referred to as the profit of a company. On an accounting statement, it’s the amount that comes from adding the asset value and deducting the liabilities and expenses.

5. Expense:

expense in a company is everything that the company is paying to its partners, employees, suppliers, and liability owners. It includes the services charges a company pays to another company, the salaries of the employees, regular expenditures like office stationery, utility bills, and the rent for the office building or vehicles in use. In simple words, an expense is everything that is going out of the company.