Investment is considered the best way to increase the value of your money and to generate a fixed sum of monthly income. Although investment looks attractive it requires a great deal of paperwork ranging from deal confirmations to monthly, periodical, and yearly account statements as well as IRS Form 1099 tax records. It seems an overwhelming volume because it can expand your portfolio too but it is necessary to manage your account information. It is the only way to have a certification against your investments that your instructions are followed and no unauthorized transactions are made. Efficient investment records will help you to have important information on hand to use at the time of need such as at the time of filing tax returns. Proper documentation of investment will keep you aware of any wrong deed with your account.

Investment record keeping will help you to have proof of your investments because after investment you should have important documents with you to reveal the time of investment, amount of investment, and all relevant details you may need to strengthen your case.

Contents

Tax Records

A proper investment record will help you simplify the process of preparing your federal income tax returns and state returns as applied. If you have made investments in tax-deferred accounts such as IRA or 401 (K) then it is necessary to pay income taxes. Income tax is necessary to pay with stocks-bearing dividends. In the case of reinvestment of dividends and mutual funds or interest income from bonds, you have to pay income taxes. Capital gain taxes are applied on the sale of investments on profit. In short, the right information and documentation of investments will help you to estimate your tax liability.

You can personally manage your investment account without hiring an expert accountant. First, you need to do is to create a worksheet for each investment and include all the information, such as the date and value of investment, shares, and commission paid. If your investment is a gift from someone other and you have not purchased it then you can record the information after getting it from the former owner. In the case of an inherited investment, you will have to record a market value on the day your sponsor’s estate was valued.

Free Investment Record Template

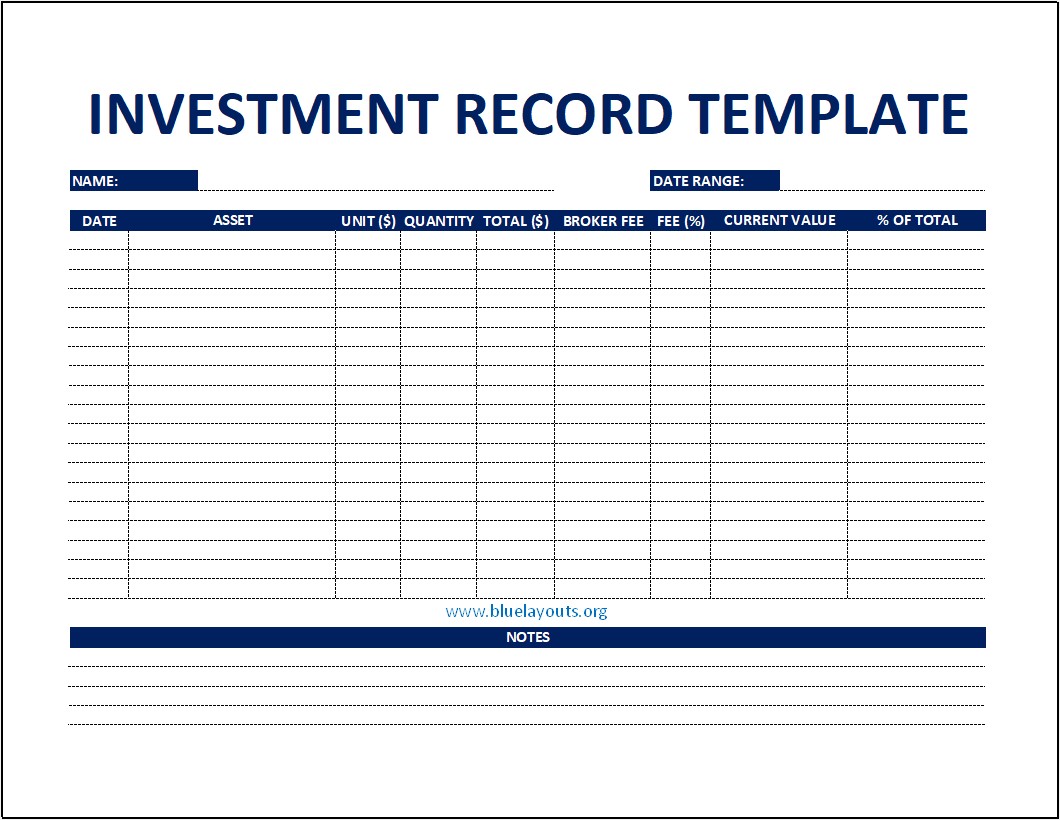

Here is a preview of this free Investment Record Template to help you in the process of record keeping for your investments,

Here is the download link for this Investment Record Template,

Investment Recordkeeping

You have to keep investment account statements and other vital details of your investment firm or financial institution. It will be good to divide your investment records based on short-term and long-term references for your convenience. Do not forget to overhaul your investment records once a year to discard useless records on time. For instance, after getting the end-of-the-year summary, there will be no need to keep monthly statements that you have received throughout the year.

Items for Long-term Storage File

- End-of-the-year summary account statements from financial institutions about your investment account and statements of different saving plans.

- Copies of annual IRS Form 1099s that will provide details of dividends, interest, and capital gains from your investments.

- Transaction records to confirm your sale or purchase of stocks, bonds, and other investments. Their records cannot be found at brokerage firms so it will be a smart approach to keep all these details with you.

This record is important for tax purposes because it can often affect the performance and value of your investment. You have to be careful while discarding your investment records as someone can misuse these records so discard them properly.

Investment Record Template FAQs

Why should I use an Investment Record Template?

Using an Investment Record Template can provide several benefits. It helps organize and centralize information about your investments, allowing you to easily track their performance and make informed decisions. The template can also assist with tax reporting, as it provides a comprehensive record of your investment transactions and related financial data.

What information should be included in an Investment Record Template?

An Investment Record Template should gather details regarding the investment such as units purchase date, price, close, market value, and the profit or risk linked with the investment.

Where can I find an Investment Record Template?

Investment Record Templates can be found online through various sources. Many financial websites, investment platforms, or personal finance software provide downloadable templates that you can customize to suit your specific needs.