Download this Accounts Receivable Ledger Template to assist you in your day-to-day tasks.

Accounts receivable are very important for every organization therefore different companies prepare a special schedule to maintain their accounts receivable. Accounting jobs are really rewarding jobs because the fast-paced atmosphere and great demand for accounts receivable managers make it an ideal position for those who can do this job. It can be an ideal position and you can get a handsome amount for this work. Accounts receivable are those accounts to which companies offer credit therefore it is necessary to monitor the accounts receivable for the smooth flow of cash transactions. Accounts receivable are those customers who make purchases from the organization with the promise to pay in the future date so companies have a special person to keep a record of all these customers.

Contents

- 1 Free Accounts Receivable Ledger Template

- 1.1 Tips to Maintain Accounts Receivables

- 1.1.1 Accounts Receivable Ledger Template FAQs

- 1.1.2 What is an accounts receivable ledger template?

- 1.1.3 How can an accounts receivable ledger template help a business?

- 1.1.4 What information is typically included in an accounts receivable ledger template?

- 1.1.5 Can an accounts receivable ledger template be customized?

- 1.1.6 Share this:

- 1.1.7 Related

- 1.1 Tips to Maintain Accounts Receivables

Free Accounts Receivable Ledger Template

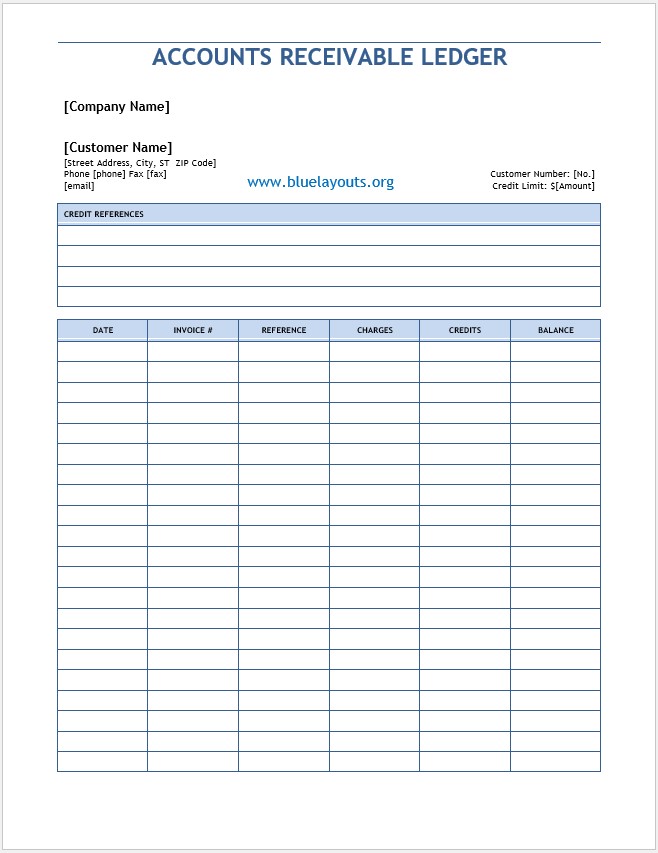

Here is a preview of this Accounts Receivables Ledger Template,

Here is the download link for this Accounts Receivable Ledger Template,

Tips to Maintain Accounts Receivables

Different organizations use aging schedules to maintain proper accounts receivable because it is considered convenient for your help, I am going to share some important tips to maintain accounts receivable:

- In the first step, you have to decide which schedule you want for the maintenance of your accounts receivable. You can use an aging schedule as in this schedule you have to write the name of each patron, balance, and collapse with the reference to current or past transactions.

- Open spreadsheet software as it is the best way to prepare a schedule for your accounts receivable. Name your document and then save it in the appropriate place.

- Give a title to your account receivable sheet at the top of the document, for instance, “Accounts Receivable Schedule”. Write the name of the organization and the date of sheet preparation right after the title of the spreadsheet.

- Your spreadsheet will be divided into different rows and columns so you have to name each column. The account receivable sheet usually features six columns from left to right so you can give them different titles such as “Name of Customer, Total Accounts Receivable, Current Balance, 1 to 30 Days Past Due, 31 to 60 Days Past Due and Over 60 Days Past Due”.

- To keep your accounts receivable updated, you have to check the ledge accounts of accounts receivable. It will help you to understand all transactions related to a specific account with the information of the date.

- Check your ledge account and enter the details of each customer under the columns according to the titles of each column. Do not forget to check the dates and policies of your organization for payment regarding each customer. Update your accounts receivable spreadsheet considering the due dates for the payments.

- Fill all columns appropriately and then highlight all defaulters for your convenience. You can divide the sheet into more rows and columns as per your requirements to prepare a details accounts receivable sheet. Well-maintained accounts receivable will help you to smoothly maintain the accounts of your organizations.

I hope the above-mentioned tips will help you to maintain accounts receivables appropriately according to the requirements of your organization as an accountant. However, for keeping a record of your cash expenses you can also use a readymade cash receipt template to effectively manage cash transactions.

Accounts Receivable Ledger Template FAQs

How can an accounts receivable ledger template help a business?

An accounts receivable ledger template can help a business by providing a structured tool to monitor and manage customer invoices, payments, and outstanding balances. It helps businesses keep track of customer transactions, identify overdue payments, assess payment trends, and maintain accurate records for financial reporting.

What information is typically included in an accounts receivable ledger template?

An accounts receivable ledger template usually includes fields for recording customer details (name, contact information), invoice number, invoice date, due date, payment terms, amount billed, the payment received, and outstanding balance. It may also include additional columns for tracking payment dates, late fees, and any relevant notes.

Can an accounts receivable ledger template be customized?

Yes, an accounts receivable ledger template can be customized to meet the specific needs of a business. Depending on the complexity of the business operations, additional fields or formulas can be added to track additional information such as discounts, credits, or aging of receivables. Customization allows businesses to tailor the template to their unique requirements and improve efficiency in managing accounts receivable.