Here you can download these free Cash Receipt Templates to design your own. Cash receipts are written documents that are necessary to maintain a sound record of cash sales. These cash receipts are important for all types of business organizations. Such receipts help maintain proper records of their monthly cash expenses. People prepare cash receipts in different ways according to their use and the nature of the business. Usually, cash receipts include an item list, the quantity of each item, the transaction date, the total value of cash sales, and the total amount of sales tax. You might also be able to go through our Payment Voucher Templates as well.

You can handwrite these receipts using a computer to generate them according to the nature and size of the business because some small-scale business organizations cannot afford software programs to design and maintain cash receipts. Cash receipts are equally important for a businessman and a common person because, in the absence of cash receipts, you cannot enjoy their all possible benefits.

Contents

- 1 Free Cash Receipt Templates

- 2 Benefits of Cash Receipts for a Businessman

- 3 Types of Cash Receipts

- 3.1 Sales Receipts

- 3.2 Loan Receipts

- 3.3 Investment Receipts

- 3.4 Rent Receipts

- 3.5 Tax Refund Receipts

- 3.6 Cash Receipt Templates FAQs

- 3.7 What is a cash receipt template?

- 3.8 How can I use a cash receipt template?

- 3.9 Why should I use a cash receipt template?

- 3.10 Can I customize a cash receipt template?

- 3.11 Share this:

- 3.12 Related

Free Cash Receipt Templates

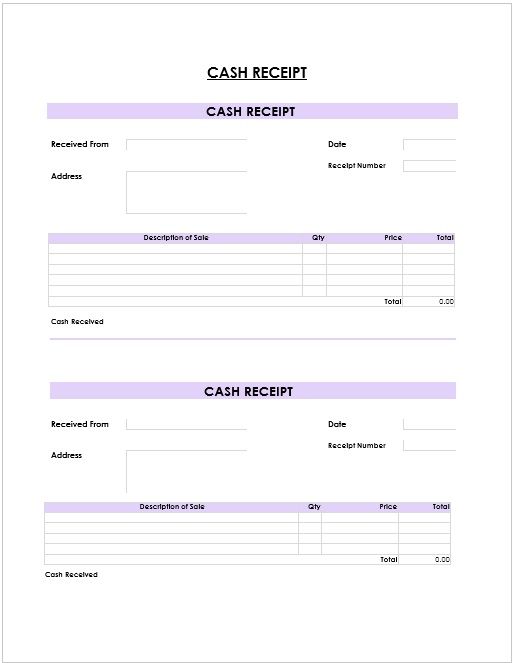

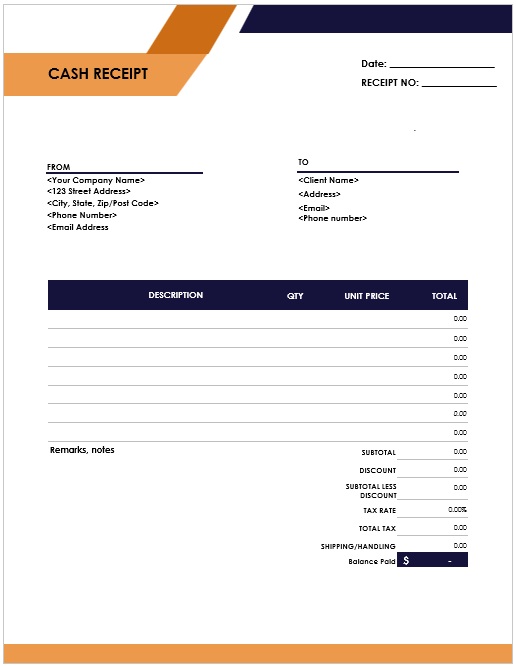

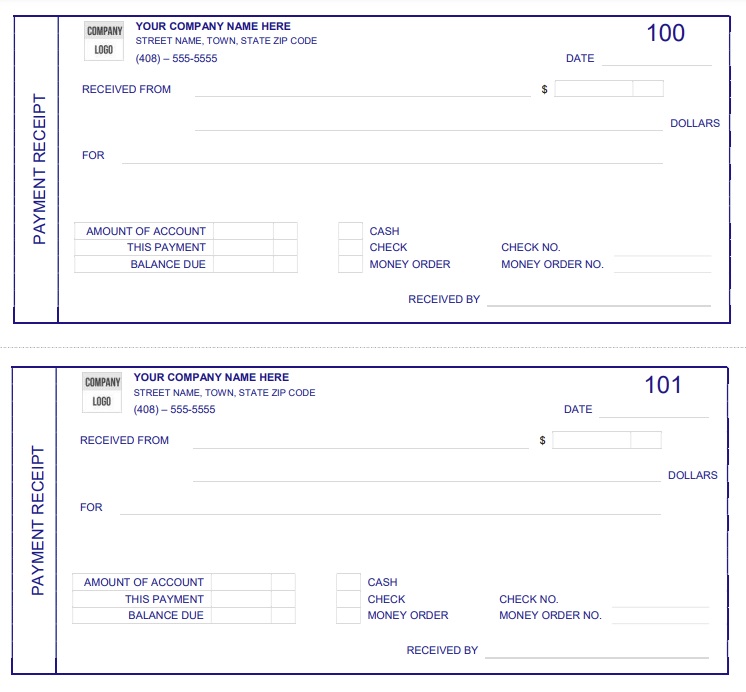

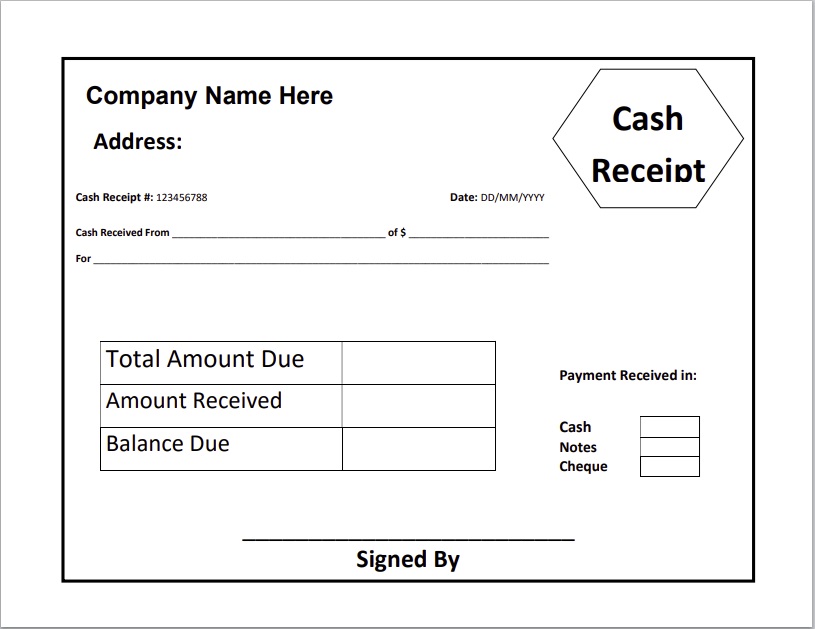

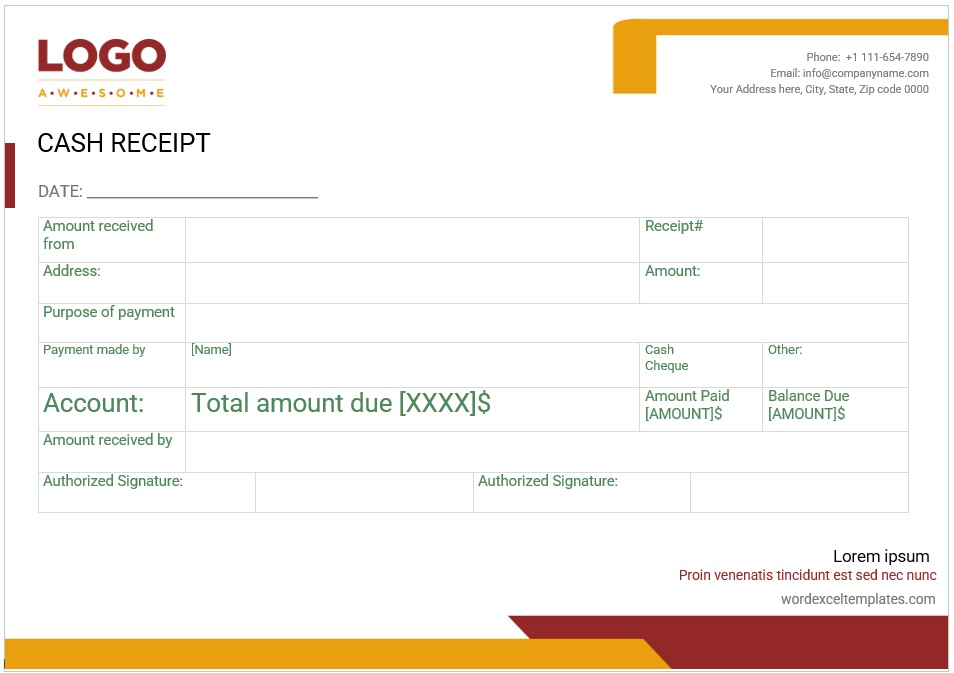

Here is a preview of this Cash Receipt Template using MS Word,

Here is the download link for this Cash Receipt Template,

Benefits of Cash Receipts for a Businessman

Cash receipts are really important for a businessman because these help them to maintain their financial accounts. Following are some benefits that a businessman can enjoy with the use of cash receipts:

- After a selected transaction, each business receives a cash receipt and it is necessary to document everything in the ledger and accounting books. It helps you to track records of all purchases including materials and equipment. This is necessary to record all purchases in the ledger immediately because it will help you while compiling financial accounts. It will decrease the chances of errors or omissions in the financial accounts.

- Cash receipts are important for sellers also because it is necessary to record all sales in the income head of the business. While running a sales business, you have to keep copies of all cash receipts in different forms such as cash register logs, database copies, and carbon copies of handwritten receipts. Cash receipts should be arranged consecutively to manage the audit process. Cash receipts help you to record all transactions with dates and proper amounts.

- A businessman must file and store cash receipts in chronological order. Keep them in the folder and have records in the computer system also. Your filing, storing, and recording of cash receipts will be entirely based on the total volume of your business. It is necessary to record these receipts in the cash ledger to have an accurate estimate of cash flows.

- Try to prepare a complete record of cash receipts in a separate folder because it will help you compile a perfect cash ledger. You should have a record of cash receipts for at least five years.

- It is necessary to keep all cash receipts with proper account details because some cash transactions are managed from the petty cash account. It will help you to maintain the whole cash flow of your organization.

- A proper record of cash receipts will save you from different future conflicts because sometimes you have to show your cash receipt while auditing and maintaining financial accounts.

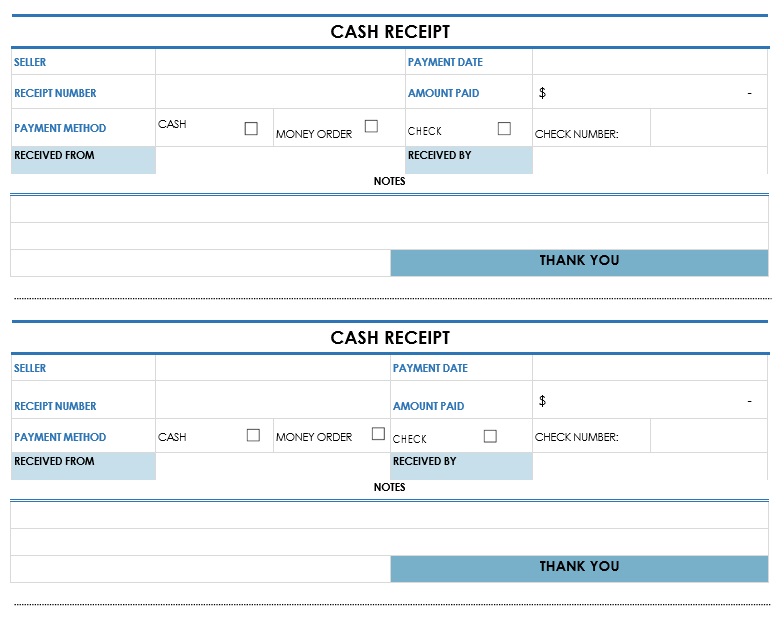

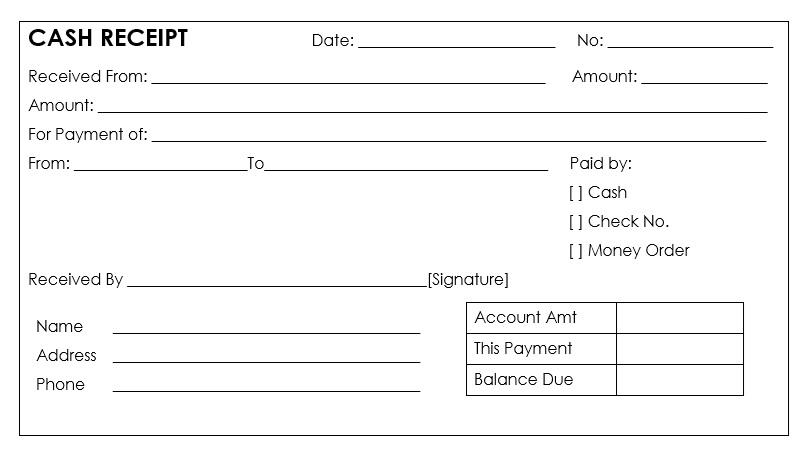

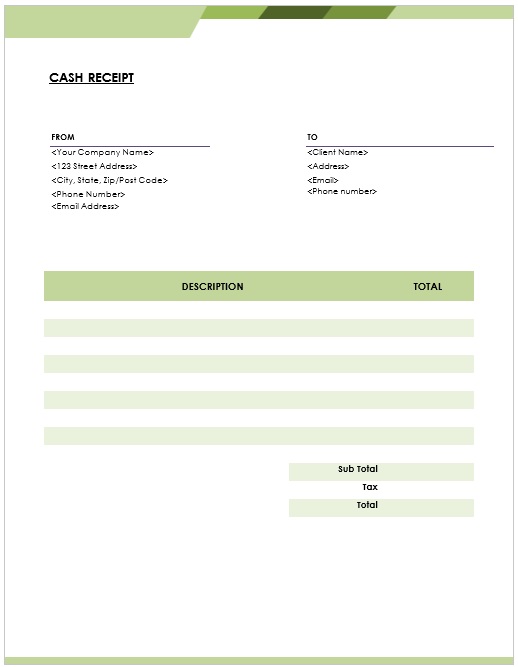

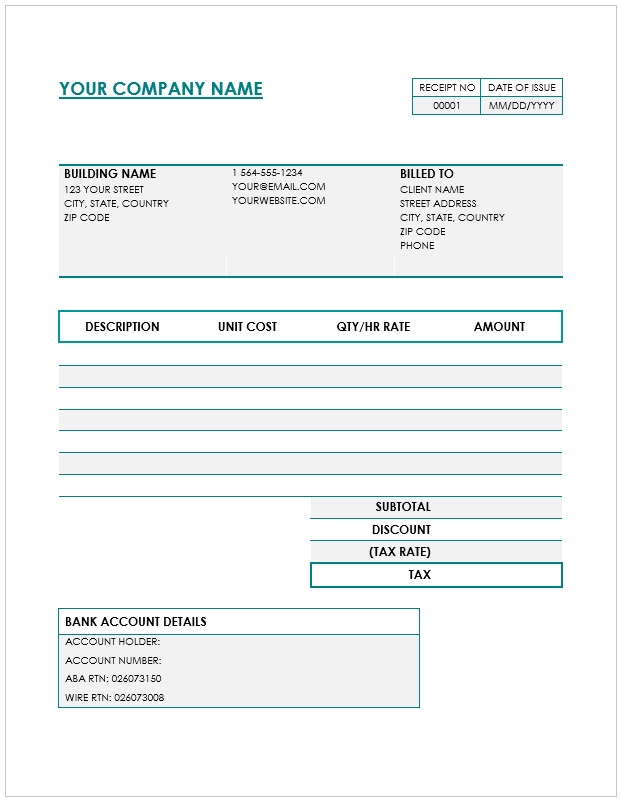

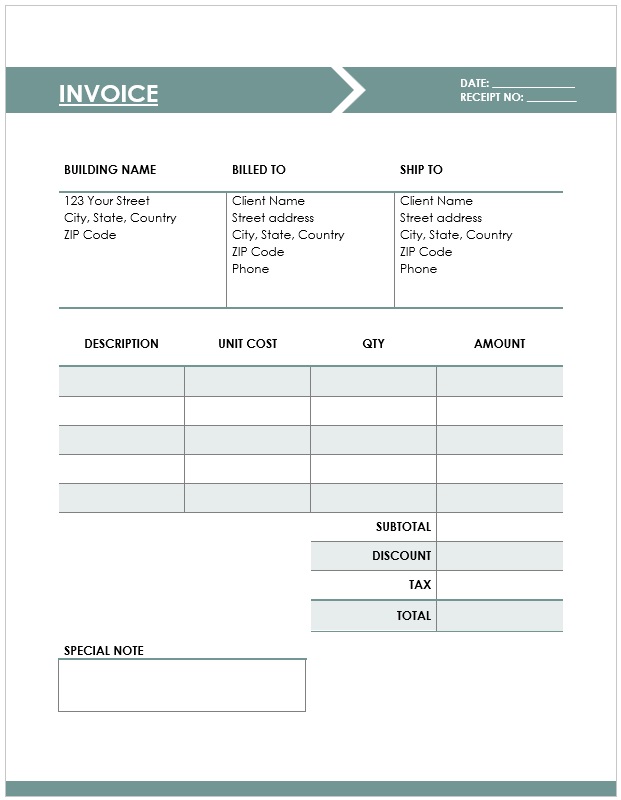

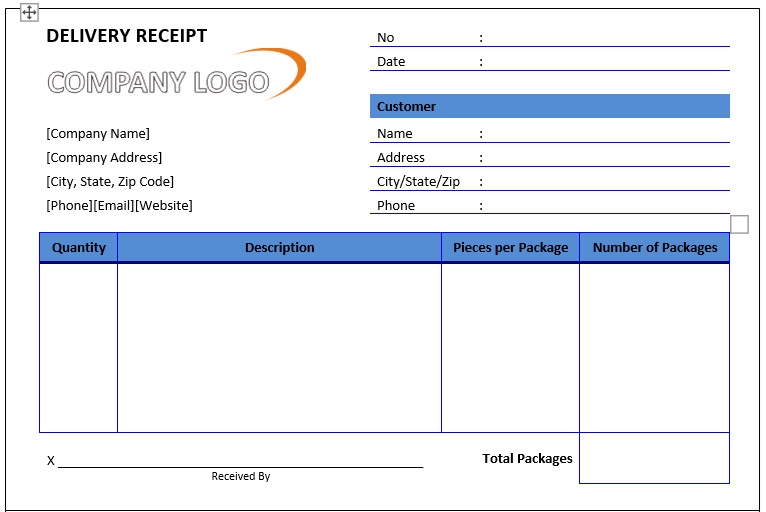

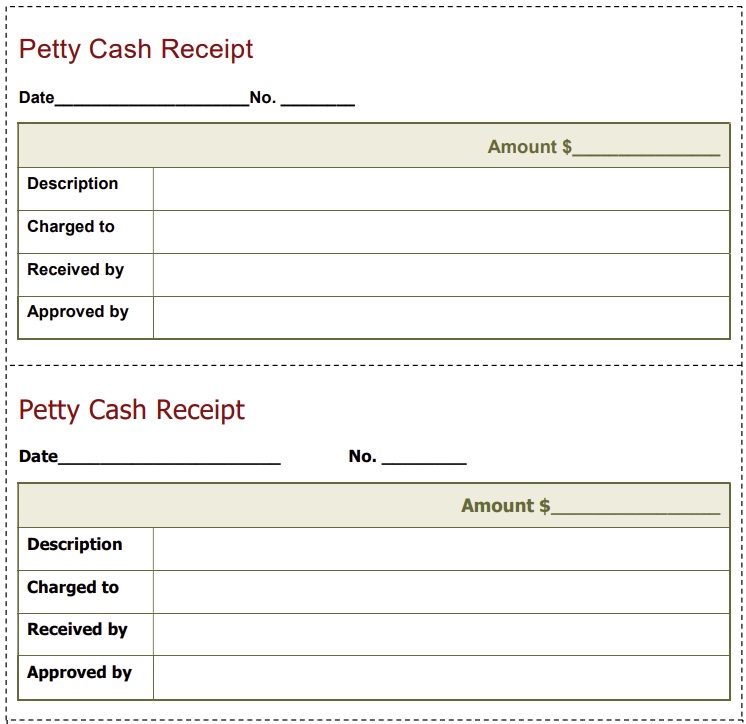

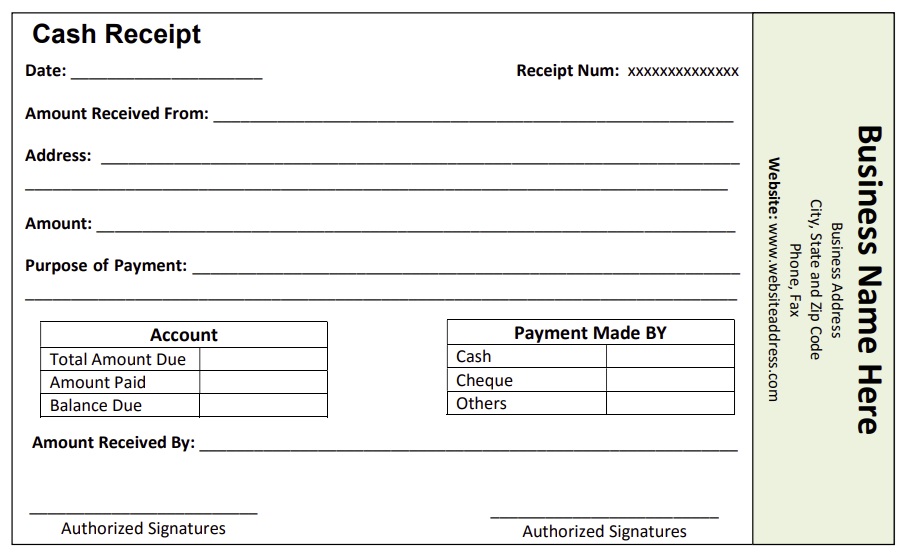

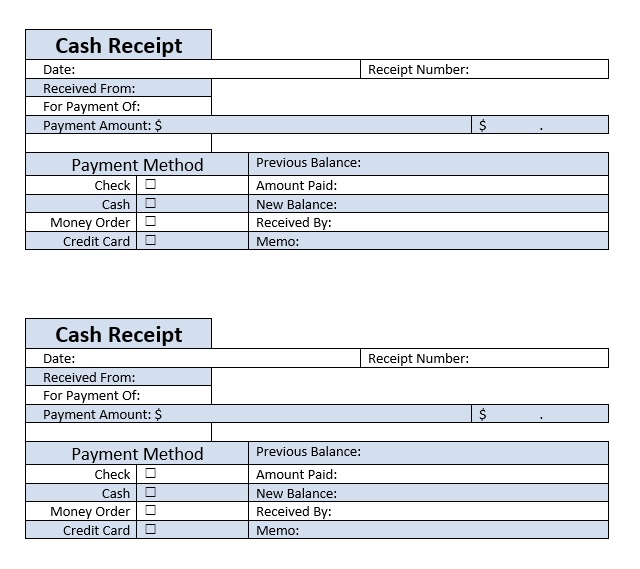

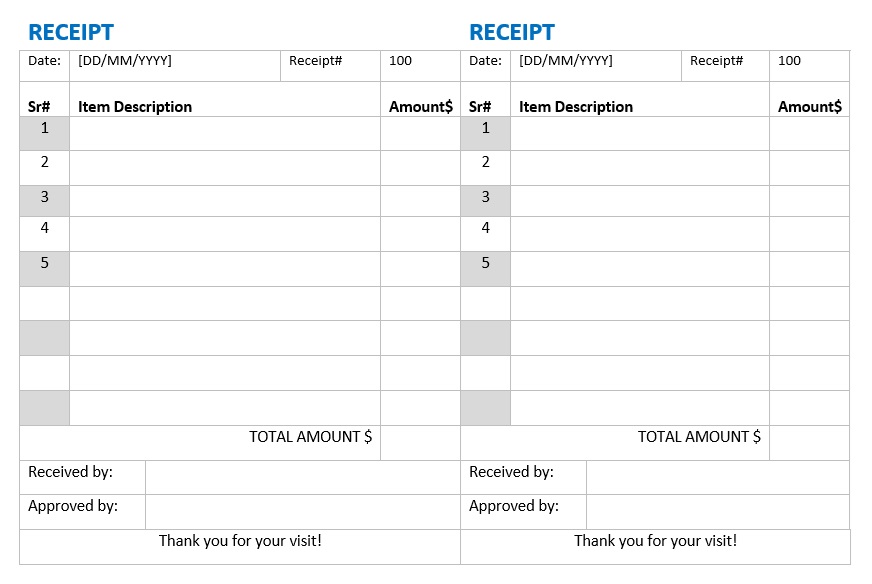

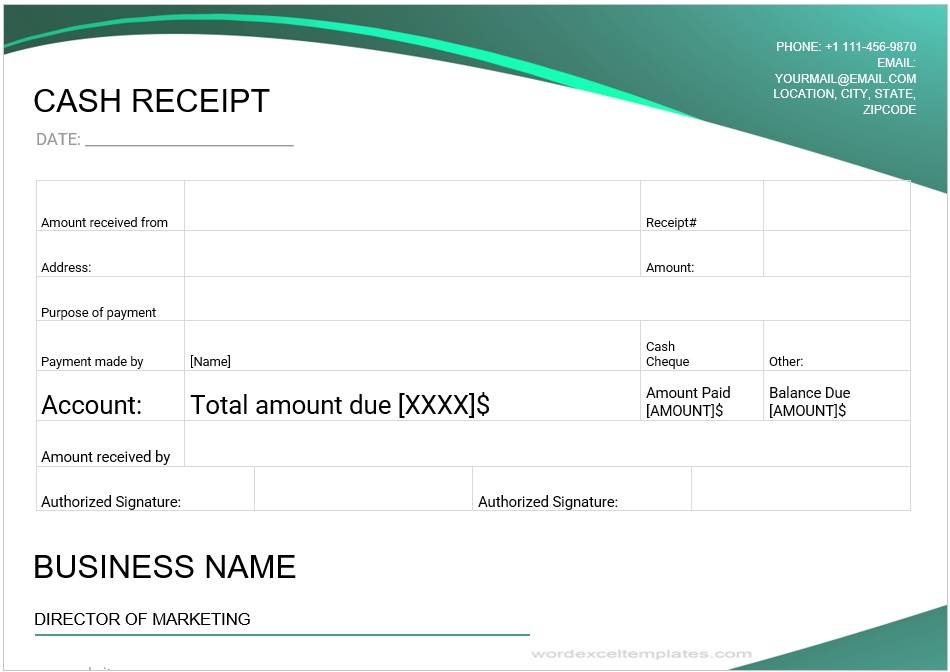

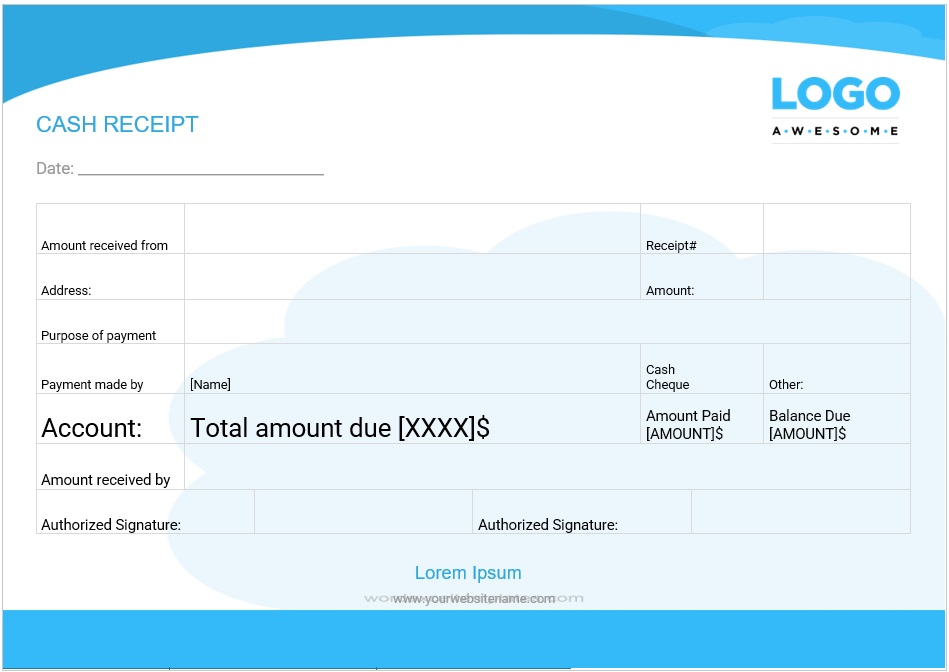

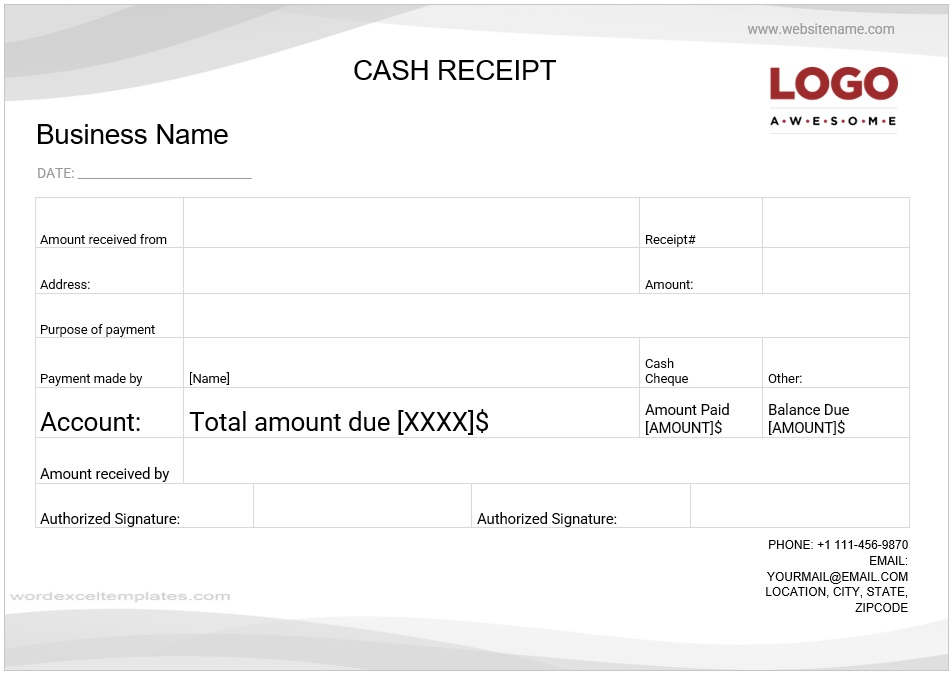

More Free Cash Receipts Printable,

Types of Cash Receipts

Here are common types of Cash Receipts being used in the market.

Sales Receipts

The sales receipt is a written acknowledgment of an exchange between a buyer and a seller in which the former pays the latter for goods or services. This document provides evidence of the transaction and usually entails the following information: date, items sold, price, overall amount, and form of payment. When customers pay using cash, a credit card, or an electronic payment, businesses produce sales receipts. The receipts are useful because they are an aid in recording and accounting for sales and for ensuring precise financial accounts. Also, they are used for different purposes by customers, such as returning goods, warranties, or for their internal documents. No matter the scope of the business, whether a small retail shop or a huge organization, sales receipts fulfill the role of recording and confirming a certain financial operation in a company.

Loan Receipts

A loan receipt is evidence that one has borrowed money from the bank any financial institution or even an individual. It is proof that the borrower has taken a loan and is liable to repay the amount according to the terms and conditions. It has in its context the loan amount, date, interest, payment arrangement, and the lender’s details. The loan receipts are kept for the purpose of effective monitoring and management of the finances of businesses and students. Such receipts are vital for audits, taxation, and record-keeping in the future. In addition, they offer a transactional safeguard for both parties involved.

Investment Receipts

An investment receipt verifies the receipt of money from a particular investor in exchange for stocks, bonds, or related assets. It represents evidence that an investor has supplied funds to the business entity or financial institution. The receipt usually contains certain details such as the invested amount, date, nature of the investment, and the issuing institution or company. Investment receipt is used by companies to record capital inflow and maintain accounts. Investors retain them for tax declaration or any other legal usage in the future. They make financial dealings easier by ensuring that all processes are followed and keeping both sides safe.

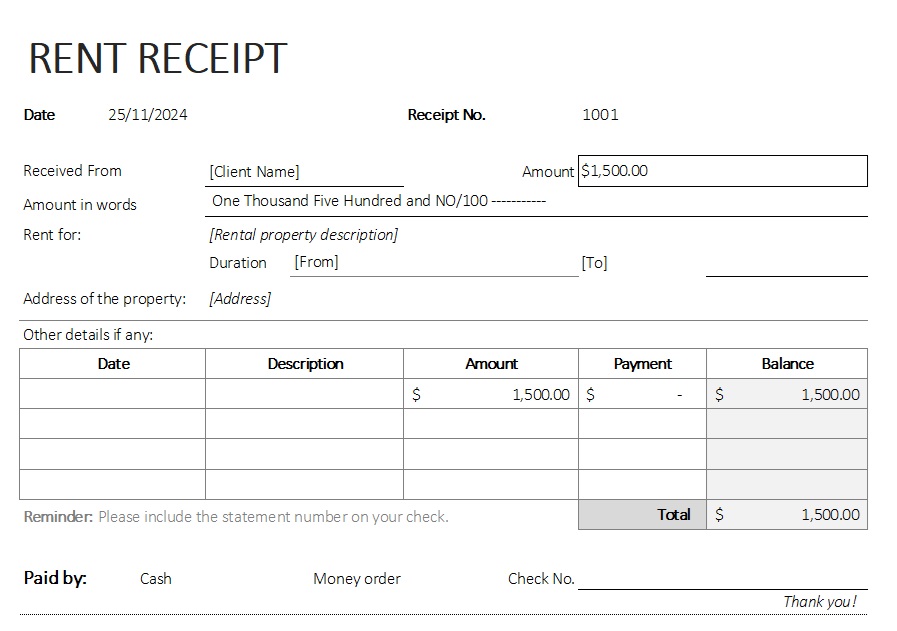

Rent Receipts

The receipt of rent is a document that proves that the tenant has paid the rent to the landlord for the use of any property. It details the date of payment, the amount, the month for which rent is due and the signature of the landlord. Rent receipt is utilized by tenants to support any payments for their own reference, tax reclaim or any purpose in court. It is issued for clarity of finances to landlords and in order to avoid any legal confrontations. For tenants and landlords, rent receipts allow them to manage payments better, and there is no room for shady dealings when dealing with rent agreements. It can assist landlords and tenants solve financial rental property issues, whether it is residential or commercial because of the roles they play as measures of due diligence.

Tax Refund Receipts

A tax refund receipt is an official form of invoice issued to a taxpayer who has paid more tax than they owed and has received the excess back from the government. The receipt verifies that the taxpayer has received a refund of the excess amount which had been wrongfully paid in taxes in a given year. The information that most tax refund receipts contain includes: the amount refunded, the refund date, the taxpayer’s details, and the reason for the refund. Tax refund receipts are also kept by individuals as well as businesses with the purpose of assisting in financial reporting, audits, and tax returns in the following years. These receipts enable one to keep a search for the refunds; also one is able to compare any payments already made with the expected tax payment thus avoiding overpayment. The denomination of tax services rendered is clear in them.

Cash Receipt Templates FAQs

How can I use a cash receipt template?

Using a cash receipt template is simple. You can either download a template online or create your own using word processing software. After downloading the receipt template you can make amendments and make full customization by adding a business logo, and other details as best suit your needs. When you receive cash from a customer or client, fill in the necessary details in the template and provide a copy to the payer as proof of the transaction.

Why should I use a cash receipt template?

Using a cash receipt template offers several benefits. You can maintain consistency in your financial records by providing a standardized format for documenting cash transactions. It also helps the user add essential details accurately, such as payment received and payment method. Additionally, using a template saves time and effort by eliminating the need to create a receipt from scratch for every transaction.

Can I customize a cash receipt template?

Yes, you can customize a cash receipt template to suit your specific needs. Most templates are editable, allowing you to add or remove fields, modify the layout, and incorporate your branding elements. Customizing the template enables you to align it with your business's requirements and create a professional-looking receipt that represents your brand effectively.