Home equity is the souk value of a proprietor’s tangential interest in real property which is a disparity between the fair market value of the home and the outstanding balance of all liens on the property. Equity of your home starts mounting after making payments against the credit balance and this situation also appreciates the value of your home. Equity starts building after the payment of the mortgage because equity is the value of your home minus the amount of debt you have that uses your home as collateral. For instance, if the value of your house is $500,000 and you owe $240,000 on the mortgage then your total home equity is $260,000. You can access this equity at any time via a home equity line of credit that is quite similar to a credit card. A home equity line of credit is a useful way to secure the credit line comparison to your home equity.

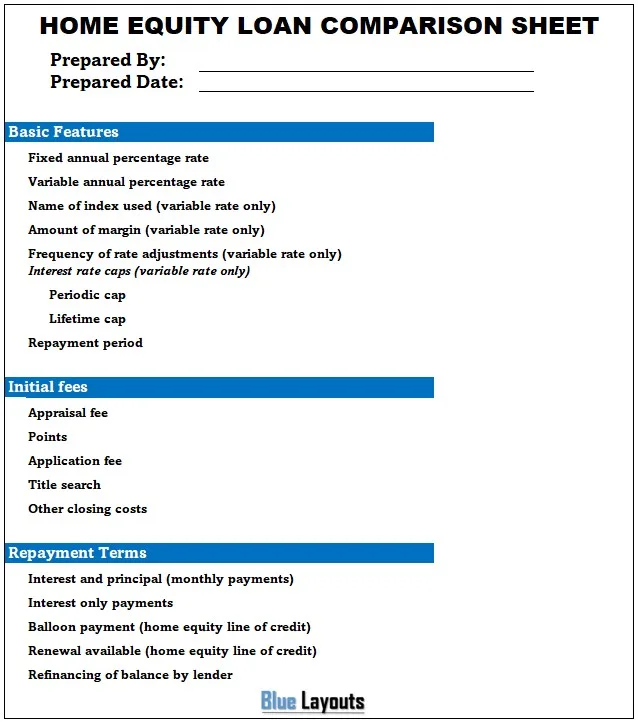

Here is a preview of a sample Home Equity Loan Comparison Sheet created using MS Excel,

Here is the download link to above mentioned Home Equity Loan Comparison Sheet,

Home equity loans require something as collateral so it is necessary to consider different factors to understand the whole financial situation:

Contents

Understand Interest Rate

Interest rate is the most important factor that can impact your lines of credit. You have to check for certain rules and regulations because the low rates can increase your line of credit over time. Some lenders have the practice of offering special rates for short periods. If you require some immediate cash for a short interval then you have to pay it off before the introductory period otherwise it can go beyond your affordability. You have to keep this point in mind that the lines of credit should have an interest rate cap.

Count the Costs

There are different costs other than interest rates that can affect your line of credit. There is a fixed fee that should be paid as the closing costs of your home loan. If you want to increase the value of your home then you have to pay a special fee to set up special credit lines. Your pay point options can diminish your rate of interest. You may also have to pay title search costs, mortgage preparation and filing fees, property insurance fees, and fees to attorneys to carry on the whole process. Taxes are directly associated with all monetary transactions so you also have to pay taxes. You can request your lender to prepare an outline of all possible fees so that you can manage your expenses according to it.

Determine Your Budget Limits

Your home will be used as primary collateral against your loans therefore your home will be at risk in case of any default. You have to select an open line of credit for your home to make sure that you can handle everything carefully within your budget. Any rise in interest rate will increase your payment so set your equity line of credit carefully according to your budget and balance you have. Sometimes, you have to make full payment at the end of the month so you have to make sure that you can pay in full without any further borrowing or problem.