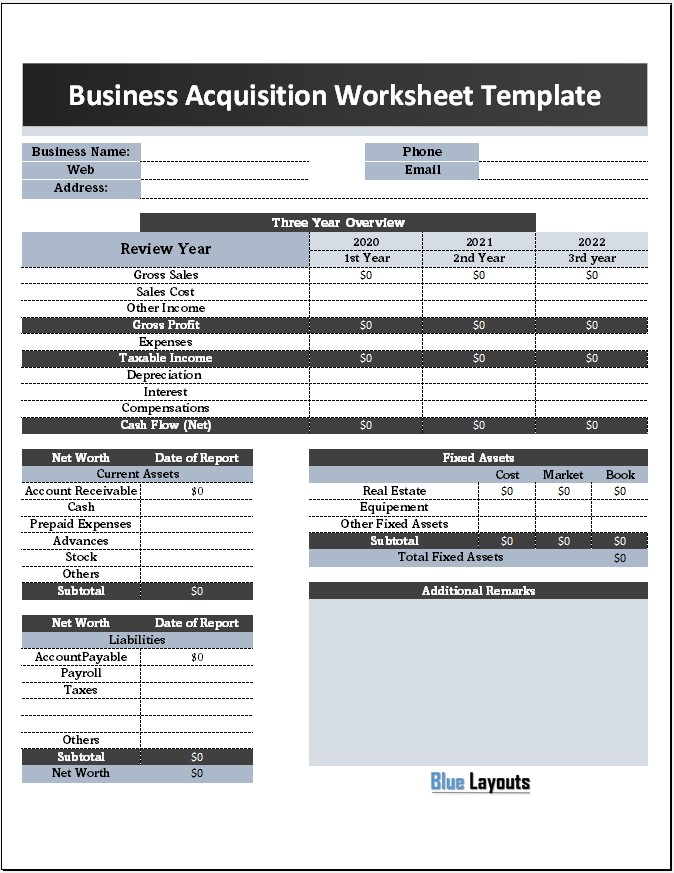

Here is a Business Acquisition Worksheet that can help anyone input key information to evaluate the worth of a business. This worksheet provided a tabulated format to review and analyze the last five years’ data to compute the overall worth of any business. This data consists of sales revenue, total expenses, depreciation, interests, etc. It also offers a very good analysis of current assets and liabilities to predict the future potential of the business being evaluated. This is an Excel Sheet Template that can easily be modified and tailored as per situation and needs. Such sheets are crucial to prepare before buying or selling any kind of business as they help in computing the correct value of that business. Acquisition is a normal activity in the business because different companies often make acquisitions to build revenues and make the company a more frightening competitor in the industry.

Business acquisition is not a simple process because lots of effort and processes are required to pursue it. In mergers and acquisitions, the company being acquired is referred to as the target company. Through the acquisition process, a specific company actively combines its business activities with the required company instead of waiting for its formal sales with the consent of the management team. Business acquisition is carried out after the combined decision of the management of both companies because they find more benefits in running a combined business instead of a standalone business. To acquire another business, you have to prepare a business acquisition report.

Contents

- 1 Free Business Acquisition Worksheet Template

- 2 Tips to Prepare Business Acquisition Report

- 3 Quality Business Acquisition Worksheet Template FAQs

- 3.1 What is business acquisition?

- 3.2 Why would a company consider acquiring another business?

- 3.3 What are the key steps involved in a business acquisition?

- 3.4 How is the value of a business determined during an acquisition?

- 3.5 What are some common challenges in business acquisitions?

- 3.6 Share this:

- 3.7 Related

Free Business Acquisition Worksheet Template

Here is a preview of this Business Acquisition Worksheet Template

Here is the download link,

Tips to Prepare Business Acquisition Report

Business acquisition is an important report that is necessary to prepare at the time of acquisition so for your convenience today I will share some tips to prepare a business acquisition report:

- Compose complete historical financial information to highlight past performances of the company by displaying revenues and profits. It will assist you to check out the position of your company. You have to compile profit and loss statements, balance sheets, and cash flow statements back five years.

- Describe the operations of the company on the initial pages and talk about the details of products and services your company has offered and their feedback from the market. Write concise background histories such as the date on which the company is founded and any accomplishments to date. Write a comprehensive summary of the current revenues and profits of the company.

- Write the strengths and weaknesses of the company to clarify the competitive advantages. Discuss patents and other intellectual property that have long-lasting value for your enterprise. You can also write the details of loyal customers of the company.

- Write a profile of your management team because a strong and experienced management team has great value for any organization. Explain key details of your team members and their contributions to your organization.

- You can present your acquisition plan and try to build an attractive case to convince other members of how this organization can improve its revenues and profits in the future. Describe the positive trends in the market and write in detail how these can be beneficial for the company.

- Describe your strategies and explain the reasons why the acquisition can be helpful for both entities and how everything can be turned in the favor of your business.

- Write potential cost savings with the combination of staff and other facilities as well as resources of the organization. Share the strategies that will help you to enjoy the benefits of resources available by both organizations.

- Present your financial projects by looking ahead to the performance of three to five years of the company to get the financial results of the organization. Attach profit and loss statements, balance sheets, and cash flow statements at the end of the business acquisition report.

Quality Business Acquisition Worksheet Template FAQs

Why would a company consider acquiring another business?

There are several reasons that a company considers acquiring another business. For instance, improving technologies, bringing diversification in the products, exploring new markets, gaining more market share, and improving business profitability.

What are the key steps involved in a business acquisition?

It involves multiple crucial steps, negotiation for the setting of terms and conditions, managing finances when needed, and compliance with regulatory authorities along with the integration of the business of the buying company's operations.

How is the value of a business determined during an acquisition?

The value of a business in an acquisition is typically determined through various valuation methods, including financial analysis, market comparisons, asset valuation, and future earnings projections. However, other critical factors like brand value, the customer base of the company along with the growth potential are also considered during acquisition.

What are some common challenges in business acquisitions?

Business acquisitions can present various challenges, including cultural integration issues, differences in management styles, financial and legal complexities, resistance from employees or stakeholders, and potential risks associated with the target company's financial health or undisclosed liabilities. Thorough due diligence and effective post-acquisition integration planning can help mitigate these challenges.