The mortgage is a type of credit that is typically backed by real property via a mortgage memo as legal proof. A mortgage is considered a secure way because it gradually reduces the amount of principal in the fixed installment. It enables you to pay your loan back in adjusting monthly installments. A biweekly mortgage is one of the many types of mortgage programs. A biweekly mortgage can dramatically cut your interest cost therefore it is considered a safe way for the repayment of loans. A Biweekly mortgage lets the person split the total amount of reimbursement every two weeks. Different finance-related companies and lenders often support biweekly mortgages because they can divide your whole payment into 26 installments that enable you to pay the principal down payment at a faster rate.

Contents

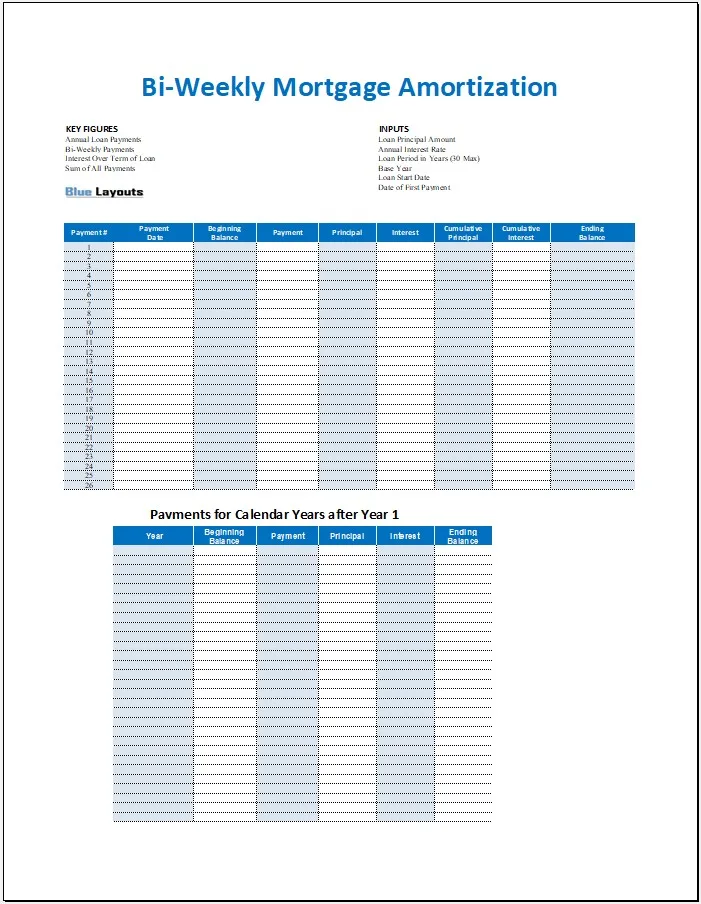

Free Bi-weekly Mortgage Amortization Sheet Template

Here is a preview of a comprehensive Biweekly Mortgage Amortization Sheet Template.

The download button for this Biweekly Mortgage Amortization Sheet Template is here.

Tips to Design Bi-weekly Mortgage Sheet

For your convenience, I am going to share some tips for designing a biweekly mortgage sheet so that you can personally estimate your loan amount and payment period:

- In the first step, you have to decide the type of twice payment every month that is convenient for you and the mortgage holder. You can choose from bimonthly, typical biweekly, true biweekly, or prepayment of ½ month. Every type of payment requires a different amount of time and involves a different amount of interest rate.

- The biweekly schedule will be best for you if you are interested in reducing the amount of interest on a loan because it is a convenient, effective, and most accepted way to reduce the interest amount on a total loan.

- Talk to your lender to know about monthly finance reimbursement and then split your amount into half to pay it on a biweekly schedule. It will help you to divide your loan into 24 equal payments right through the year.

- Some lenders require you to prepare the biweekly payment schedule but some offer this service and facilitate you with a pre-designed payment schedule you are always required to do it personally to avoid any future problems.

- You have to be extra careful while preparing a biweekly mortgage sheet because sometimes lenders hold the funds until the date of normal payment and require the full amount as normal payment. It is your responsibility to check the credit transactions written after the payment.

- If you ignore above mentioned point then there is no way to escape from additional payment so do this work smartly. Crediting the payments instantaneously will help you to reduce the principal amount and interest amount.

The formula for the Bi-weekly Mortgage Sheet

Note down your principal amount in the sheet and then calculate your biweekly mortgage with the help of the following formula:

Take the annual percentage rate and divide it by 26 to get an accurate interest rate for the payment period. For a 40-year, $250,000 mortgage at 8 percent APR:

0.08/26 = 0.0031

If you want to calculate the number of payments then you have to multiply 26 by the total number of years:

40 * 26 = 1040

Now use the following payment equation to calculate the amount of payment:

P = L[c(1 + c)^n]/[(1 + c)^n – 1]

This will help you to prepare a complete biweekly mortgage sheet and help you to pay your loan amounts without any extra expense.

Bi-weekly Mortgage Amortization Sheet Template FAQs

What is the difference between biweekly and monthly mortgage amortization sheets?

A biweekly mortgage amortization sheet is used for mortgages with 14 days payment schedules, on the other hand, a monthly sheet is used for mortgages with 30 days payment schedules

Which elements are included in a Biweekly Mortgage Amortization Template?

Most sheets contain necessary elements such as payment number, payment date, starting balance, payment amount, principal paid, interest paid, and ending balance.