Taxes are an important part of your life because you have to pay some percentages of taxes on your income according to their nature. You have to consider tax rates while planning any investment. Taxes can decrease your profit and in this regard, a tax plan will help you in the right way. You have to be cognizant of dissimilar tax issues all through the year but the last few months of a corporation’s fiscal year are mainly significant in this regard. Income tax planning is really valuable because different income tax strategies such as accelerating costs and deferring revenue will help you to reduce taxable income. Less taxable income means a smaller income tax burden. Tax planning will prove beneficial and help you to make major decisions for the benefit of your organization.

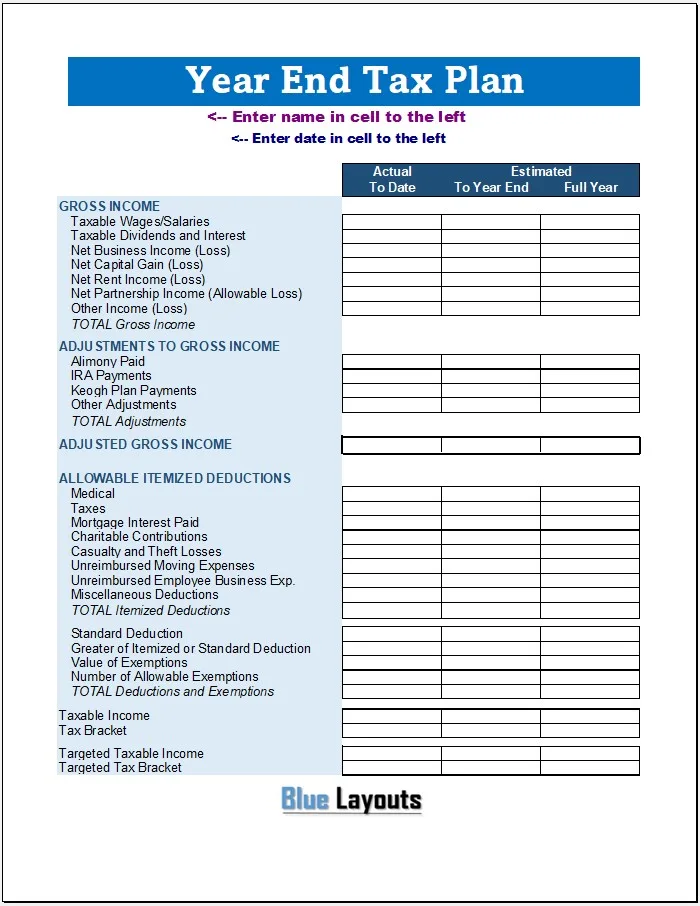

Here is a preview of a free Year-End Tax Plan Template created using MS Excel,

Here is the download link for this Year-End Tax Plan Template, Tips for Year-End Tax Plan

Tips for Year-End Tax Plan

Following are some tips that will help you to plan year-end taxes so you can concentrate on them before time:

Contents

Defer Income

An organization can defer year-end income and taxes into the following year based on its accounting methods. This can be a useful strategy but the implication of this strategy is based on the cash or accrual accounting methods of the organization. If you are using the cash accounting method then you have to count income in the similar year in which it is received. Under this method, the deferring income can be really simple as you have to receive the payments in January for the services rendered in December. Under accrual accounting, the income is calculated in the same year in which it was earned so the deferring income also required deferring sales or services.

Accelerate Expenses and Capital improvements

You can reduce the taxable income for a particular year by accelerating certain expenditures. For instance, any construction or building improvement work can be transferred to the tax-saving capital expense of the present year. You can also make the payment of undue invoices to decrease your tax liabilities. This strategy will prove beneficial and its effectiveness is based on the accounting method used by the organization.

Revisit Estimated Tax Payments

You can make estimated tax payments based on expected income throughout the year. Usually, governments require this income and it can be difficult for a business to predict the income for a whole year in advance before time but it can help you to reduce your tax burden by making some adjustments in the estimated income payment. In case of overestimation, you can reduce the final estimated payment which can be beneficial for the health of short-term cash flow.

Take Losses

It is another option that can help you to reduce your tax liability. In this way, you have to reduce your taxable income and you can do this by taking losses on inventory or other assets. It will help you to accelerate your tax benefits. For instance, an organization may own hundreds of unsold merchandise in its retail stores. You can mark those items down to recognize them as losses and it will help you to reap the equivalent tax benefits.