The payback period is the time in which a project recovers its investment expenditures. For instance, a set of solar panels may provide free operations onward but its installation cost is high and it can take years or even decades to recover the initial cost. The payback period is a widely used term in the investment areas and capital budgeting refers to the period required to get a return on investment to repay the sum of the original investment. For instance, if you have invested $10,000 with a return of $2,500 per year then your payback period is 4 years. The payback period helps you to measure the period in which you will get back your original investment. The payback period is widely used to know the advantages and disadvantages of an investment. Usually, shorter payback periods are preferred over longer payback periods. The payback period is considered an effective way the analyze the time value of money, risk, financing, and other important contemplation like opportunity cost.

Contents

Procedure to Calculate Payback Period

The payback period is expressed in years and its calculations are also started with net cash flow for each year, just like:

Net Cash Flow Year 1 = Cash Inflow Year 1 – Cash Outflow Year1

Cumulative Cash Flow = (Net Cash Flow Year 1 + Net Cash Flow Year 2 + Net Cash Flow Year 3 … etc.

You have to accumulate everything by year to get the positive number as a Cumulative Cash Flow to get the payback period. To calculate a more exact payback period you have to use the following formula.

Payback Period = Amount to be Invested / Estimated Annual Net Cash Flow 1

The following formula can also be used to calculate the payback period:

Payback Period = (p – n) / p + ny

= 1 + ny – n / p (unit : years)

In this formula:

- Ny = It reflects several years after the initial investment that reflects the last negative value of cumulative cash flow.

- N = It represents the value of cash flow at which the last negative value of cumulative cash flow occurs.

- P = It represents the value of cash flow at which the first positive value of cumulative cash flow occurs.

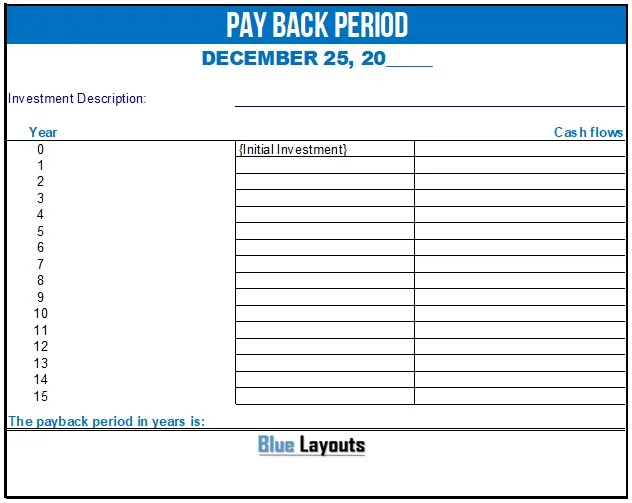

Here is a useful free Payback Period Calculator created using MS Excel to help you quickly,

Here is the download link to above mentioned Payback Period Calculator,

Payback Period for A Project

Determine the cost of the project by adding all costs and expenditures. For instance, if you are working on a project of solar panels then you have to count the cost of the panel and the labor of installation. Calculate the difference between monthly expenditures after the completion of projects and name this monthly difference as D.

Suppose the cost of the panel is $100,000 with an electricity cost of -$1000 per month because you are selling energy back to the grid. Consider that you were paying $2000 in electrical before the project then D is 2000 – (-1000) = $3000.

C – nD = o to determine how many months, n, must pass to break even. This will help you get a payback period. Suppose that C is $100,000 then the n = C/D = 100,000/3000 = 33.3 months or 2.7 years.

Time Value of Money

You can further get the time value of money with the help of the following formula:

C = D [1 – 1 / (1+i) ^ n] / i