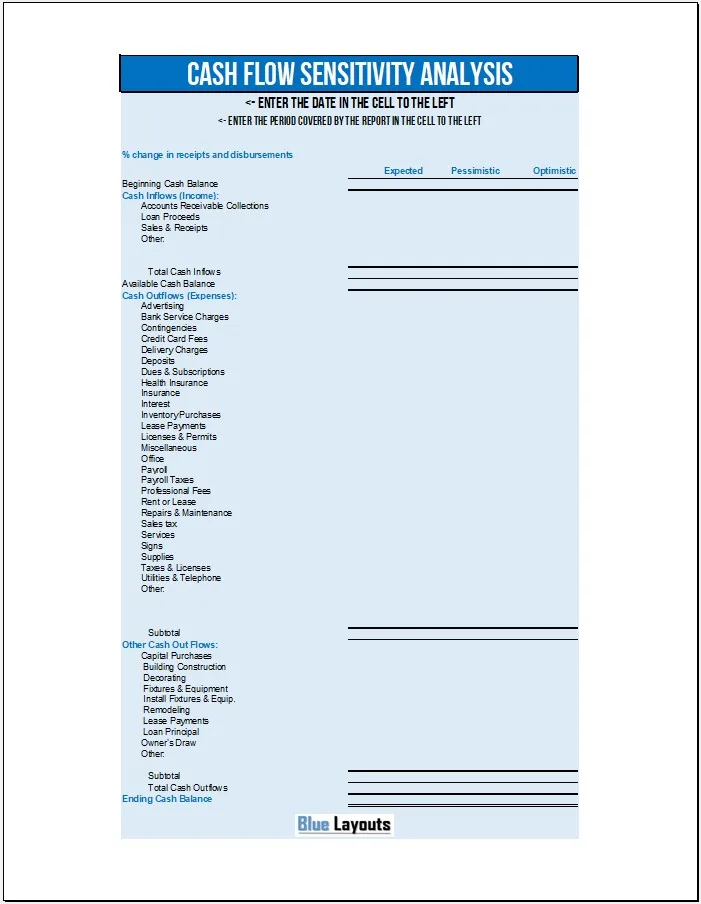

Here is a sample Cash Flow Sensitivity Analysis template that can be used to track changes in planned vs. actual Cash Flow of any company or business. This Analysis Template allows you to track the percentage of change when and where occurs to compute the overall effect and hence gives you an excellent situation to predict the future. This Cash Flow Sensitivity Analysis Template allows you to predict cash flow projections based on pessimistic and optimistic scenarios. This Excel Template is very easy to edit and also to customize from situation to situation as per specific requirements.

Here is a preview of this Cash Flow Sensitivity Analysis Template,

Cash flow sensitivity analysis is related to “what if” scenarios of your business. For instance, how 3% to 4% unexpected increase in cost can affect your cash flow? The cash flow sensitivity model will help you to understand any shortfalls of cash and let you seek any alternate way to meet your commitments.

Guidelines to Model Cash Flow Sensitivity Analysis

Development of cash flow sensitivity analysis is really simple because you have to consider two keys such as revenues and cost drivers. Mike Boehlje (Distinguished Professor, Ph.D., Purdue University) states that the long-term capital expenditures matter but these are not critical for this model. You must track periodical or annual issues directly related to the revenue stream prices, market share, quantity sold, and prices of raw materials.

Cash flow sensitivity analysis can be straightforward with the use of monthly or quarterly income statements. It can make your cash flow sensitivity easy to map out. You can simply understand it by taking a sales example such as, if your base chart of expectations is lower than the price of sales volume then you can easily evaluate your cash position and find out all those factors that are disturbing your position in the market. It will help you to understand whether you have a shortfall or surplus. You can do a similar analysis with other things such as if you want to evaluate your cost side then take fuel prices as an example. It will help you to understand your position in the market and you can make important decisions about additional financing or saving.

The cash conversion cycle is another important issue that should be addressed during cash flow sensitivity analysis. The cash conversion cycle means your liquid assets or how quickly you can convert your inventory into sales and sales into cash. The speed at which you can convert your inventory to sales and then sales to cash affects your cash flow sensitivity. It helps you to understand how quickly you can arrange cash for business operations and debt servicing. Cash flow sensitivity analysis helps you to evaluate your cash position in the given time and gives you a realistic view of the period related to the conversion of cash from nonliquid resources.

Cash flow sensitivity analysis helps you to understand your actual position in the market by considering all possible scenarios by providing you with historical records and actual past trends that will be helpful for you in future projections.